Georgia G7 – Withholding and Voucher

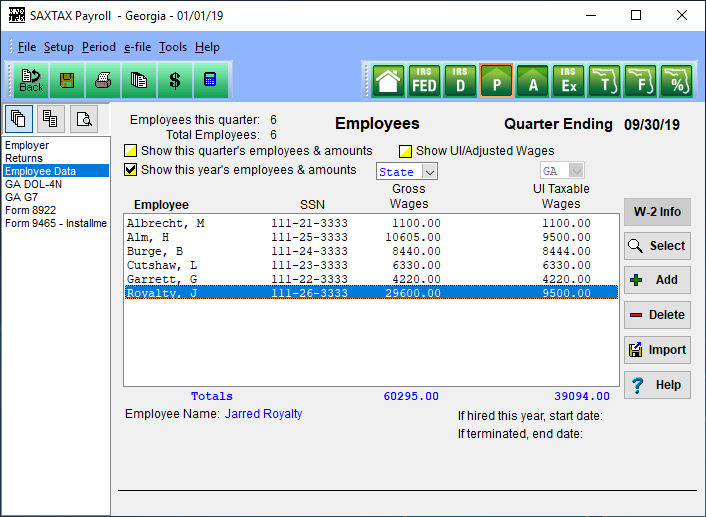

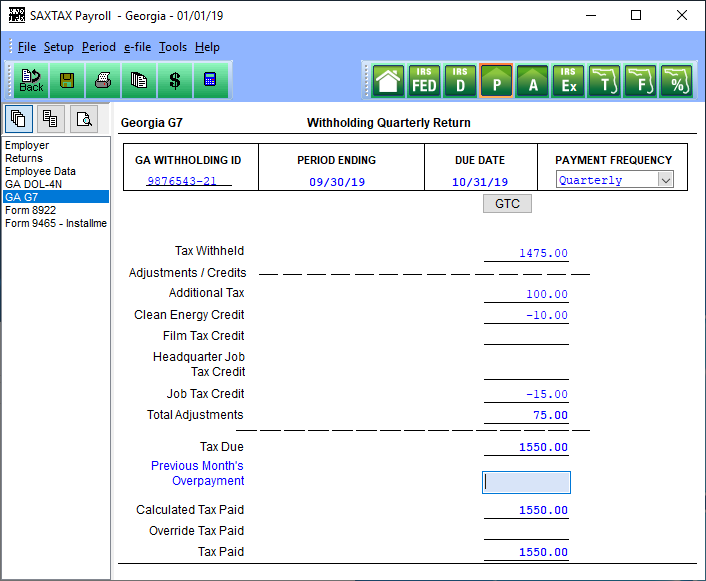

The Georgia G7 Withholding Return, uses employee data from all states and calculates the Georgia Department of Revenue tax liability. Payment Frequencies (annual, quarterly, monthly, semi-weekly, and weekly) are supported. Saxtax easily handles employees who work in multiple states throughout the year. Multiple returns for multiple companies can be batch filed.

Saxtax provides a link to the GTC (Georgia Tax Center) for easy online e-filing. Return(s) can also be printed and paper filed.

Saxtax will calculate totals on the form

like all our programs, is simple to use, created with the novice in mind. The program is a desktop application that runs on the Windows platform.

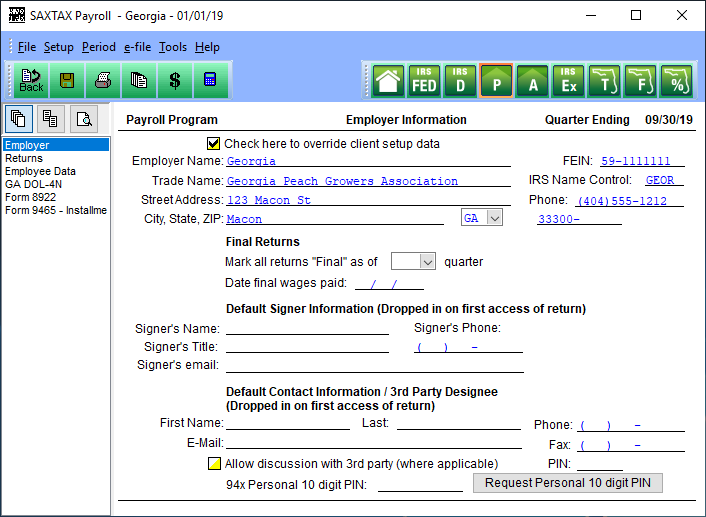

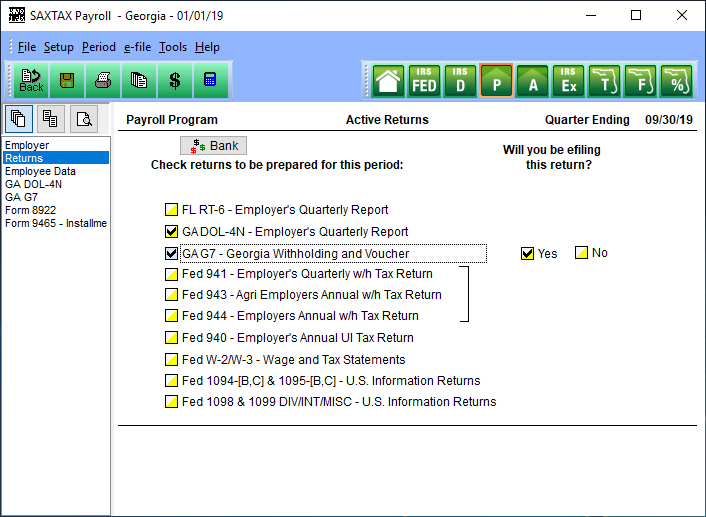

Click on the Thumbnails below to view sample program screens

[sg_popup id=”1113″ event=”click”] [/sg_popup] [/sg_popup] |

[sg_popup id=”1118″ event=”click”] [/sg_popup] [/sg_popup] |

[sg_popup id=”1121″ event=”click”] [/sg_popup] [/sg_popup] |

[sg_popup id=”1122″ event=”click”] [/sg_popup] [/sg_popup] |

| GA Payroll Employer Info | GA Payroll Returns | GA Payroll Employees | GA G7 – Withholding |

We have made this program affordable for all levels of preparation. SAXTAX Software pays for itself when considering the time and labor your office will save.

Download a Demo or Order the Georgia G7 – Withholding and Voucher Program now.

Call today for more information at (772) 337-2921.