Depreciation Program

The SAXTAX Depreciation Program is a stand alone program that calculates depreciation for up to six different depreciation “books”: (1) regular taxes; (2) alternative minimum taxes; (3) ACE; (4) Internal (financial reporting); (5) State; and (6) Other (user definable).

Depreciation data is automatically linked to all of our federal programs for printing Forms 4562 with the federal return, or the form can be previewed or printed from the Depreciation Program for association with a return. Information can also be bridged to the Tangible Tax Program for preparing Florida Tangible Personal Property Tax returns.

Depreciation reports include for each book:

- Depreciation Schedules by Asset Group

- Depreciation Summary for All Groups

- Current Acquisitions

- Current Dispositions

- Next Year and Five Year Projections

- Customized Reports

- FL Tangible Asset report

- GA Tangible Asset report

The Depreciation Program is FREE with the purchase of any federal program.

Download a Demo or Order the Depreciation Program now.

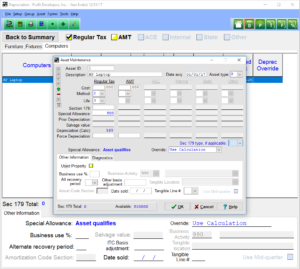

Click on the Thumbnails below to view sample program screens

[sg_popup id=”1″ event=”click”] [/sg_popup] [/sg_popup] |

[sg_popup id=”2″ event=”click”] [/sg_popup] [/sg_popup] |

| Asset Category | Asset Maintenance |

Depreciation Program Features

| Instant Calculations with Ability to Override | Year-to-Year Data Transfer |

| Print Preview | Unlimited Tech Support |

| Unlimited Number of Clients | Does Current and Prior Three Years Returns |

| Short-Year calculations |

Depreciation Forms and Reports

| Form 4562 | Form 4797 |

| Reports by Asset Group | Depreciation Summary Report |

| Current Acquisitions | Current Dispositions |

| Interim Reports by Group | Interim Summary Report |

| Customized Reports | Form 4562 and 4797 Detail |

| FL Tangible Asset report | GA Tangible Asset report |