Georgia Tangible Property Tax

The Tangible Tax Program has all the features you need including data entry screens that look just like the actual forms, drag and drop asset movement, fair market value calculations, and more. To make tangible return preparation even easier, the Tangible Program also has an “asset transfer bridge” from the SAXTAX Depreciation Program.

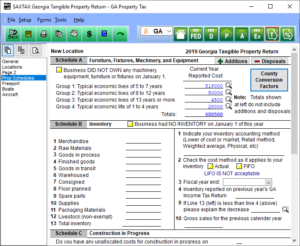

Our easy to use data entry screens are facsimiles of the actual forms, and with each entry the entire return is recalculated and totals displayed. External .csv files created by other software can also be imported.

The program’s laser printed Tangible Tax return and supporting schedules are accepted by all Georgia counties.

Supported returns include:

- PT-50P Tangible Personal Property Tax Return

- PT-50PF Application for Freeport Exemption Inventory

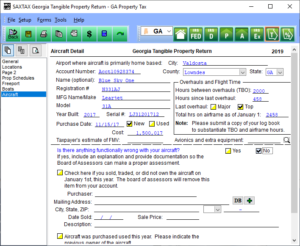

- PT-50A Aircraft Personal Property Tax Return

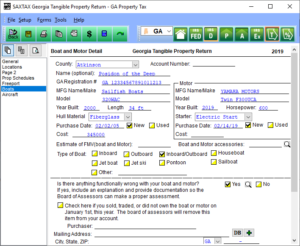

- PT-50M Marine Personal Property Tax Return

Click on the Thumbnails below to view sample program screens

[sg_popup id=”1139″ event=”click”] [/sg_popup] [/sg_popup] |

[sg_popup id=”1143″ event=”click”] [/sg_popup] [/sg_popup] |

[sg_popup id=”1144″ event=”click”] [/sg_popup] [/sg_popup] |

|

| PT-50P Georgia Business/Personal | PT-50A Georgia Aircraft Return | PT-50M Georgia Marine Return |

We have made this program affordable for all levels of preparation. SAXTAX Software pays for itself when considering the time and labor your office will save.

Download a Demo or Order the Tangible Program now.

Call today for more information at (772) 337-2921.