Georgia DOL-4N – Employer’s Tax and Wage Report

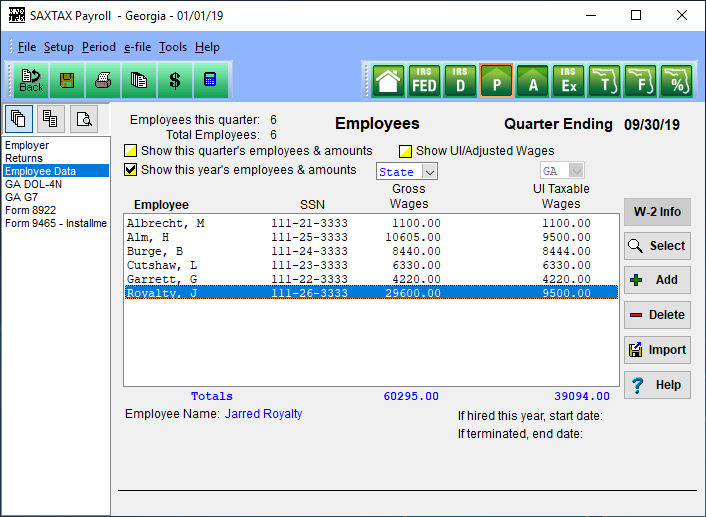

The Georgia DOL-4N – Employer’s Tax and Wage Report Program, uses employee data and wages for all states. The Saxtax Payroll program selects the Georgia employee data and wages entered and/or uploaded to fill out the DOL-4N Georgia Employer’s Tax and Wage Report.

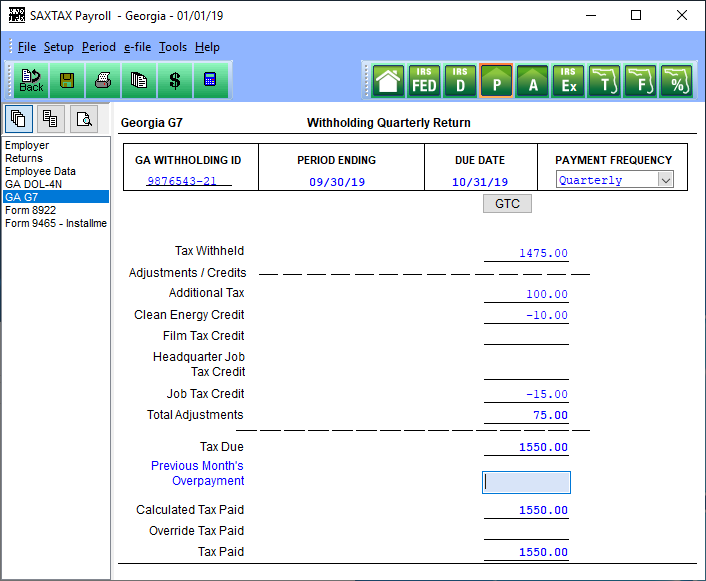

Saxtax calculates the Georgia Department of Labor tax liability and creates a file to be saved to magnetic media or that can be printed/paper filed with the GA DOL.

Click on the Thumbnails below to view sample program screens

[sg_popup id=”1113″ event=”click”] [/sg_popup] [/sg_popup] |

[sg_popup id=”1118″ event=”click”] [/sg_popup] [/sg_popup] |

[sg_popup id=”1121″ event=”click”] [/sg_popup] [/sg_popup] |

[sg_popup id=”1126″ event=”click”] [/sg_popup] [/sg_popup] |

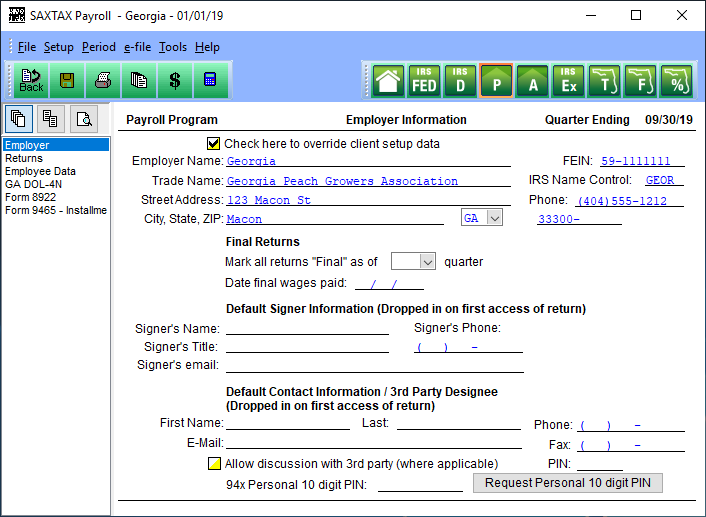

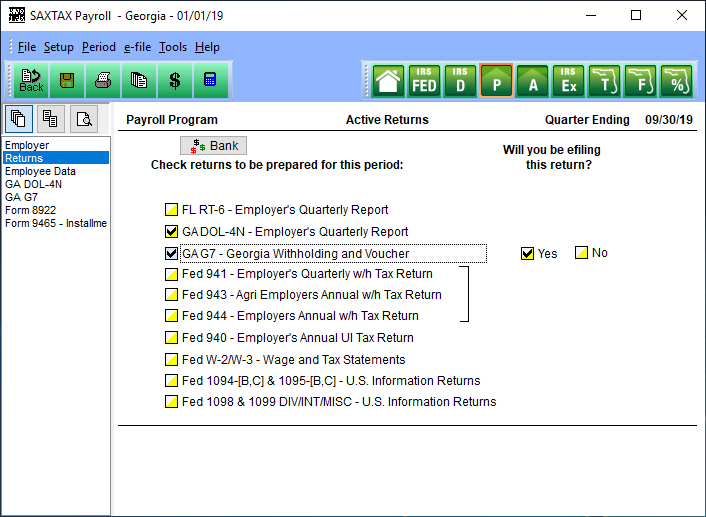

| GA Payroll Employer Info | GA Payroll Returns | GA Payroll Employees | GA DOL-4N Employer’s Tax and Wage Report |

We have made this program affordable for all levels of preparation. SAXTAX Software pays for itself when considering the time and labor your office will save.

Download a Demo or Order the Georgia G7 – Withholding and Voucher Program now.

Call today for more information at (772) 337-2921.