1065 Program

Email a PDF copy of the customer's return, without leaving the SAXTAX program. (Windows 10 required)

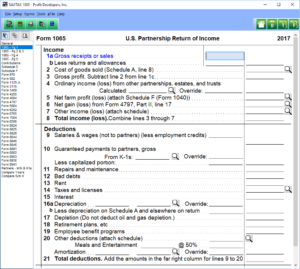

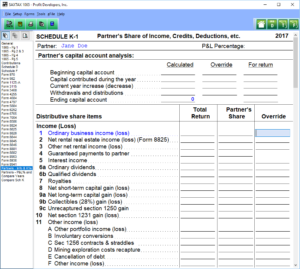

Our 1065 Program (Partnerships) features easy data entry and the automatic calculation of allocations to partners. Just enter partners' profit/loss percentages and the program takes over. The K-1 screen for each partner shows totals for the return and the partner's share of each total. Because of the complexities of partnership tax rules, you always have the ability to override calculations for special situations.

SAXTAX depreciation handles through a separate full-featured Depreciation Program that calculates depreciation for up to six different depreciation "books": (1) regular taxes; (2) alternative minimum taxes; (3) ACE; (4) Internal (financial reporting); (5) State; and (6) Other (user definable). The normal cost of our Depreciation Program is $199, but it comes Free with the purchase of our 1065 Program.

Download a Demo or Order the 1065 Program now.

[sg_popup id="10" event="click"] [/sg_popup] [/sg_popup] |

[sg_popup id="11" event="click"] [/sg_popup] [/sg_popup] |

| 1065 Page 1 | 1065 Schedule K-1 |

1065 Program Features

| Print Preview | Year-to-Year Data Transfer |

| Unlimited Number of Clients | Custom Transmittal Letters |

| Batch Printing | Custom Client Bills |

| Unlimited Number of Partners | Tickler Due Date Monitor |

| Unlimited Tech Support | Single Entry Screen for K-1's |

| Supporting Data Schedules for All Income and Expense Items | Does Current and Prior Three Years Returns |

| Instant Calculations with Ability to Override | Transmittal Letters for Forms K-1 |

| Full Featured Depreciation Program FREE |

1065 Forms and Schedules

| Form 1065 | Form 5884 | Form 8825 | Form 8916A |

| Form 970 | Form 5884A | Form 8826 | Form 8936 |

| Form 982 | Form 6252 | Form 8844 | Form 8941 |

| Form 1125A | Form 6765 | Form 8845 | Form 8949 |

| Form 3115 | Form 7004 | Form 8846 | Form 8994 |

| Form 3468 | Form 8283 | Form 8866 | Schedule B-1 |

| Form 4255 | Form 8586 | Form 8879PE | Schedule D |

| Form 4562 | Form 8609A | Form 8881 | Schedule F |

| Form 4684 | Form 8697 | Form 8882 | Schedule K-1 |

| Form 4797 | Form 8824 | Form 8903 | Schedule M-3 |