720 Program

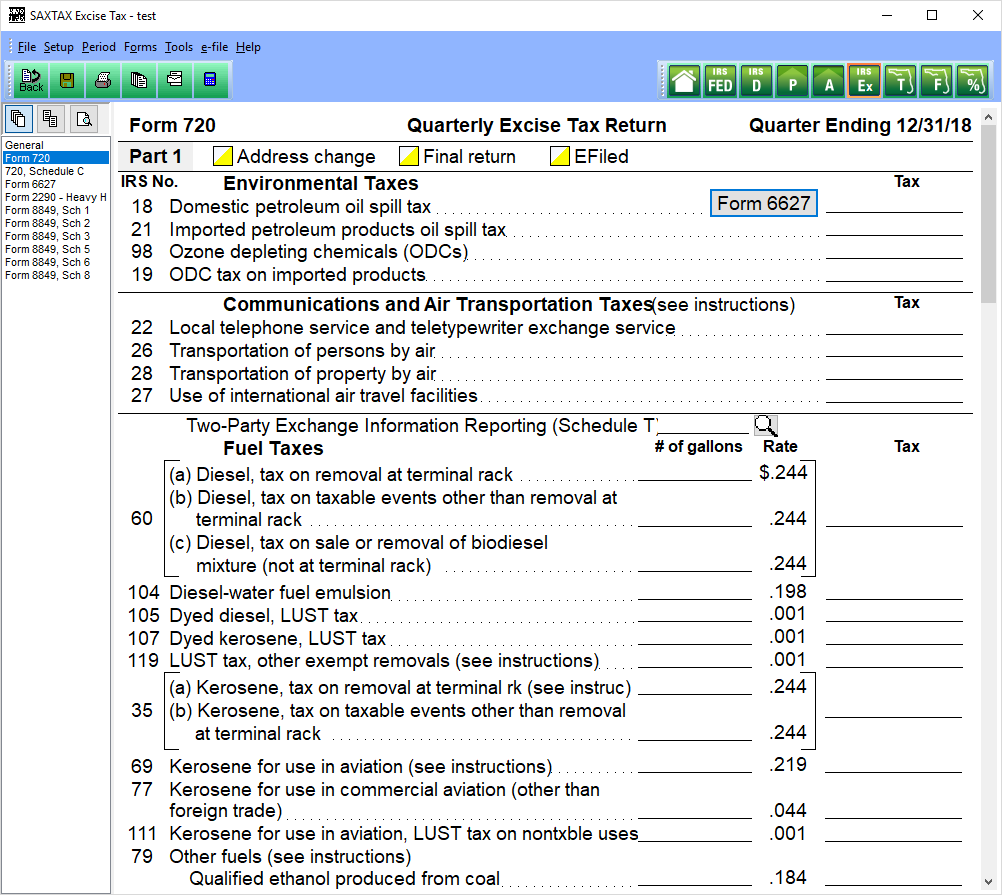

Our 720 Quarterly Federal Excise Tax Return features easy data entry for businesses with goods and services subject to excise tax.

The 720 is filed on the last day of the month, one month after each quarter.

Goods and Services subject to Excise Tax

| Part I | |

| Environmental Taxes | Communications and Air Transportation Taxes |

| Two-Party Exchange Information Reporting (Schedule T) | Fuel Taxes |

| Retail Tax | Ship Passenger Tax |

| Other Excise Tax | Manufacturers Taxes |

| Taxable tires | Form 6197 Gas Guzzler Tax information |

| Vaccine taxes | |

| Part II | |

| Patient-centered outcomes research fee | Sport fishing equipment (other than fishing rods and fishing poles) |

| Fishing rods and fishing poles | Electric outboard motors |

| Fishing tackle boxes | Bows, quivers, broadheads, and points |

| Arrow shafts | |

| Indoor Tanning Services | Inland waterways fuel use tax |

| LUST tax on inland waterways fuel use - The leaking underground storage tank (LUST) tax | Section 40 fuels |

| Biodiesel sold as but not used as fuel | Ozone-depleting chemicals floor stocks tax |

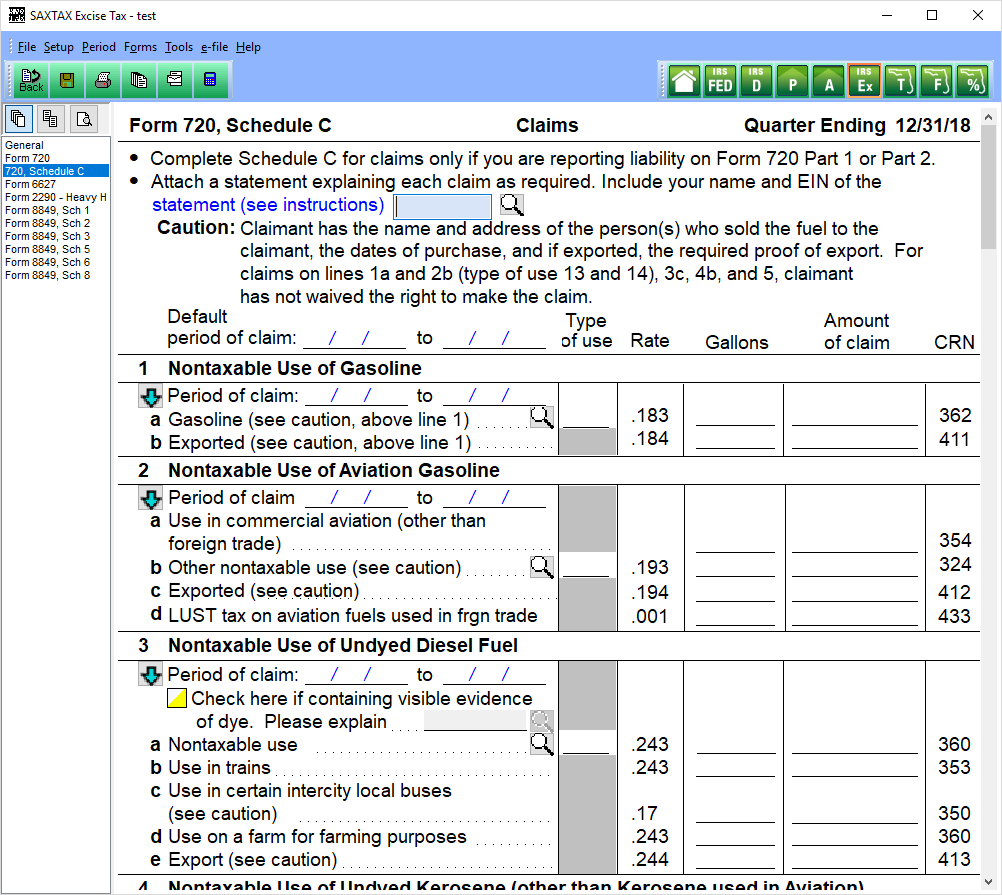

If you have an abundance of credits that accumulate during the year, you can also file Form 8849 (also included with the 720) to request a refund for any 720 credits you cannot claim with Form 720..

Download a Demo or Order the 720 Program now.

Click on the Thumbnails below to view sample program screens.

[sg_popup id="968" event="click"] [/sg_popup] [/sg_popup] |

[sg_popup id="966" event="click"] [/sg_popup] [/sg_popup] |

| 720 | 720 Schedule C |

720 Program Features

| Print Preview | Year-to-Year Data Transfer |

| Quarterly filing | Custom Transmittal Letters |

| e-filing | Amended returns |

| Unlimited Tech Support |

720 Forms

| Form 720 (tax) | Form 720 Schedule C | Form 8849 (refund) |