8849 Program

Our 8849 Claim for Refund of Excise Taxes Program is used to request refunds for prior year 2290 and prior quarter 720 returns.

If there is an abundance of credits that accumulate during the year/quarter, these schedules are used to request a refund:

Form 8849 Schedules Used To Request Refunds

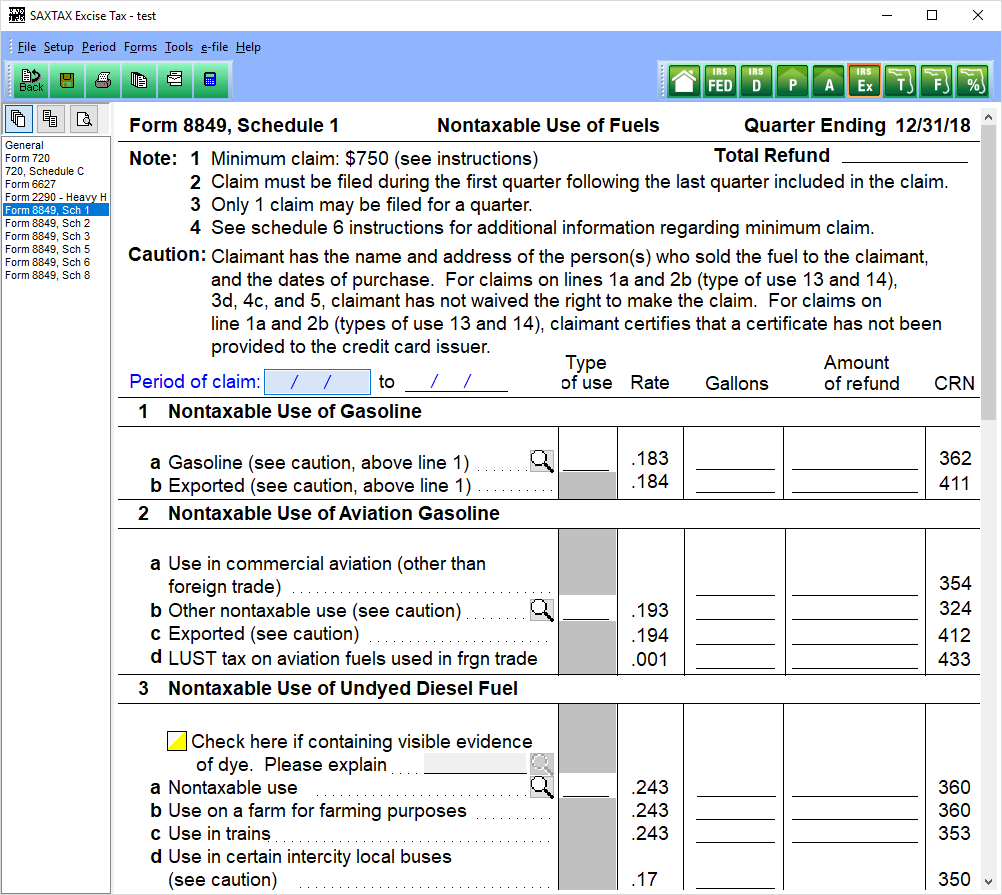

| Form 8849 Schedule 1 - Nontaxable Use of Fuels |

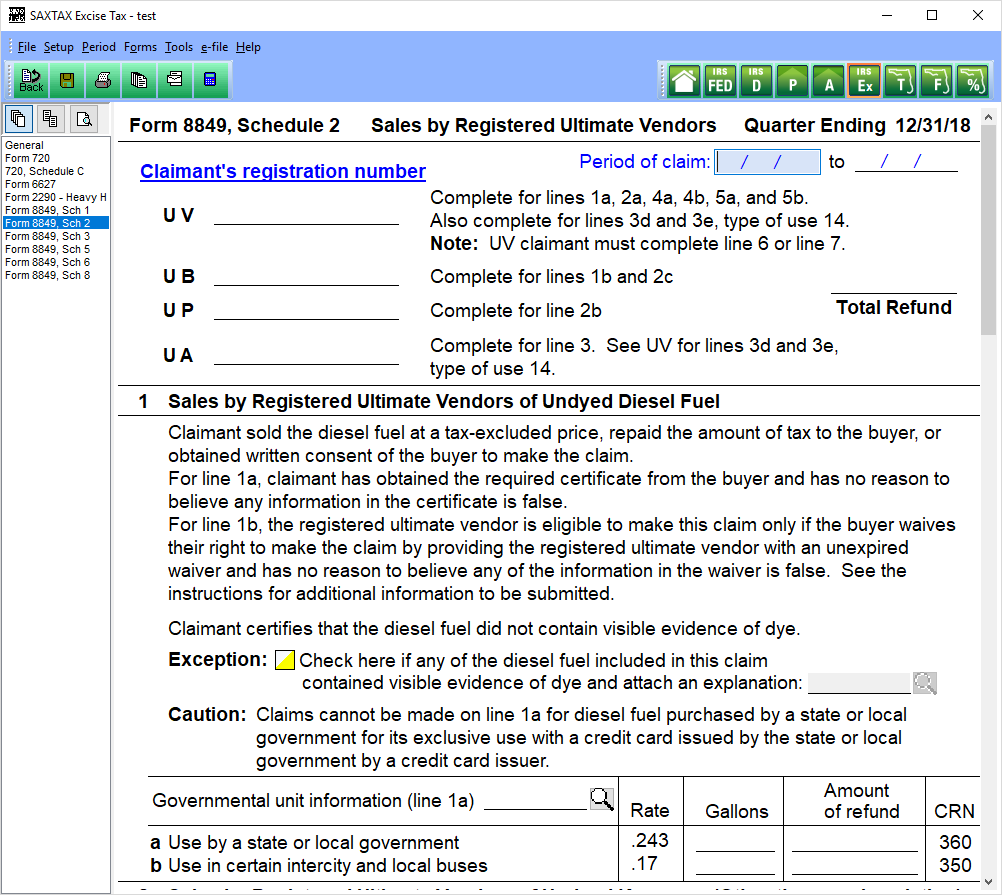

| Form 8849 Schedule 2 - Sales by Registered Ultimate Vendors |

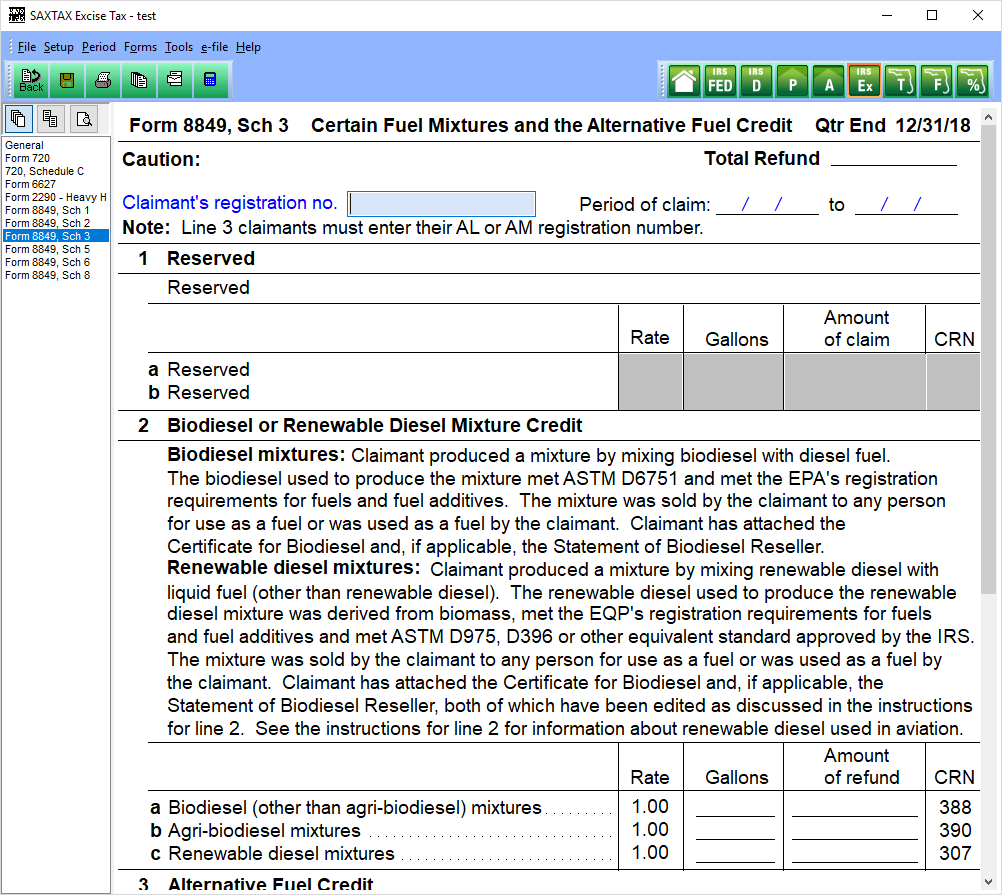

| Form 8849 Schedule 3 - Certain Fuel Mixtures and the Alternative Fuel Credit |

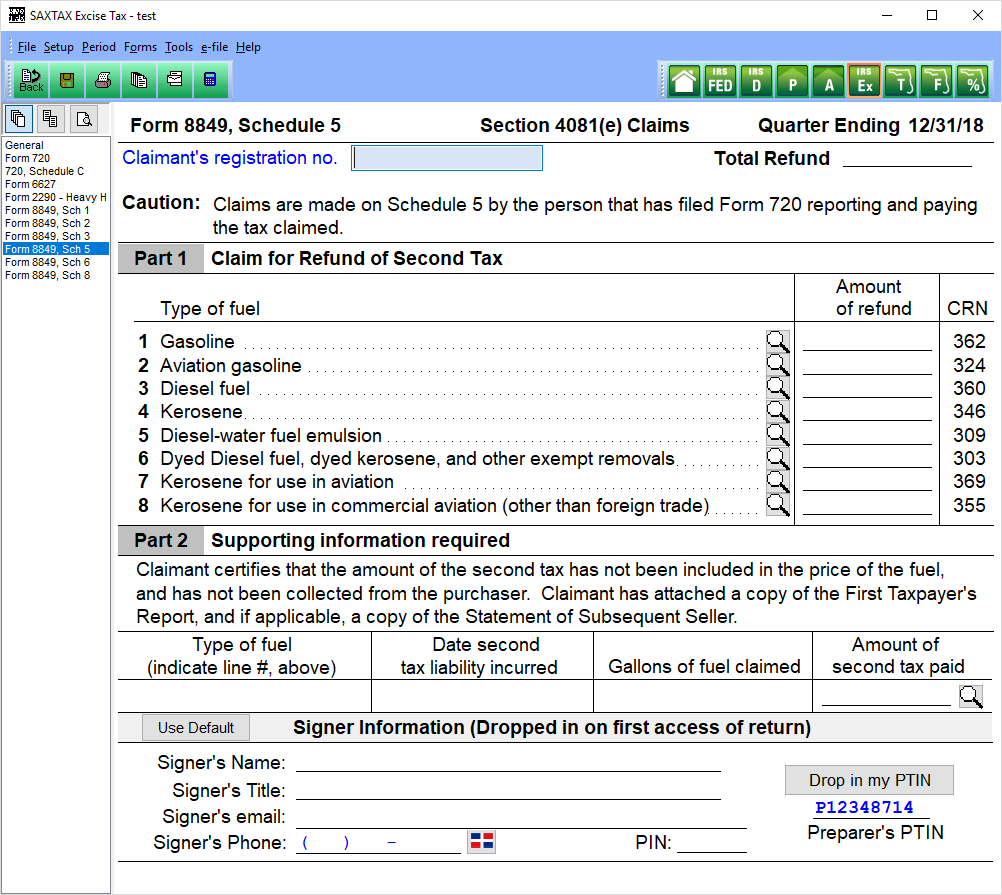

| Form 8849 Schedule 5 - Section 4081(e) Claims |

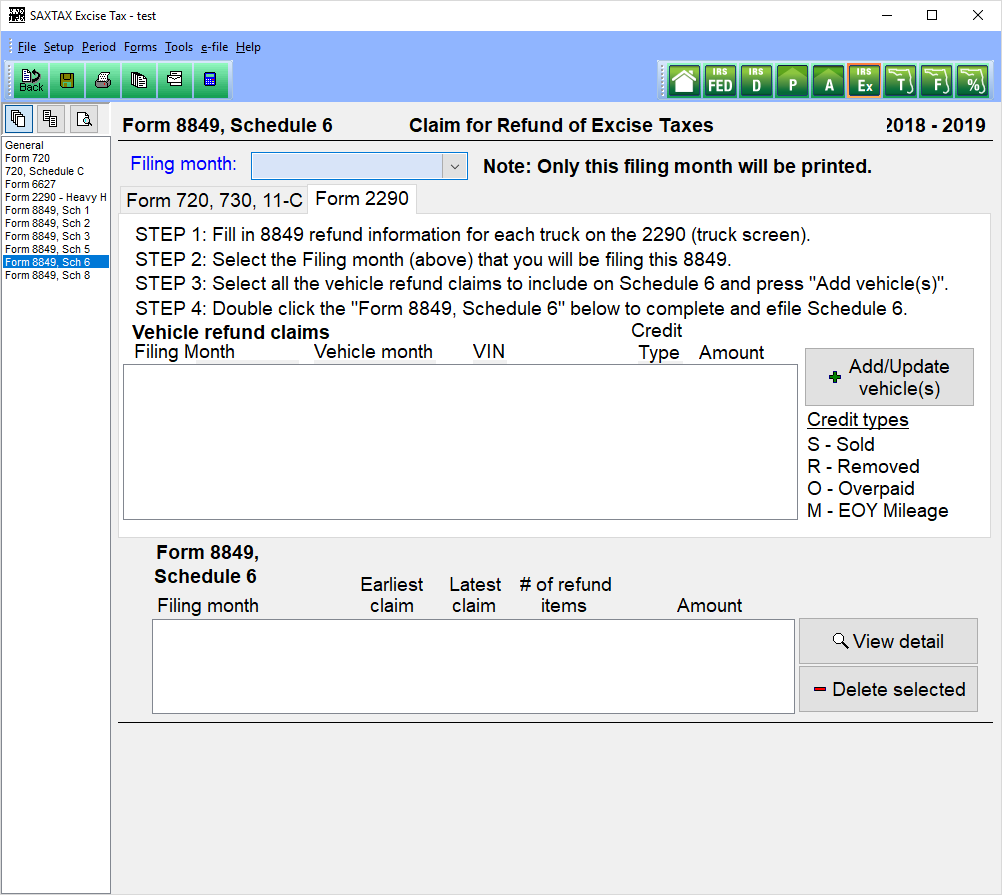

| Form 8849 Schedule 6 - Other Claims |

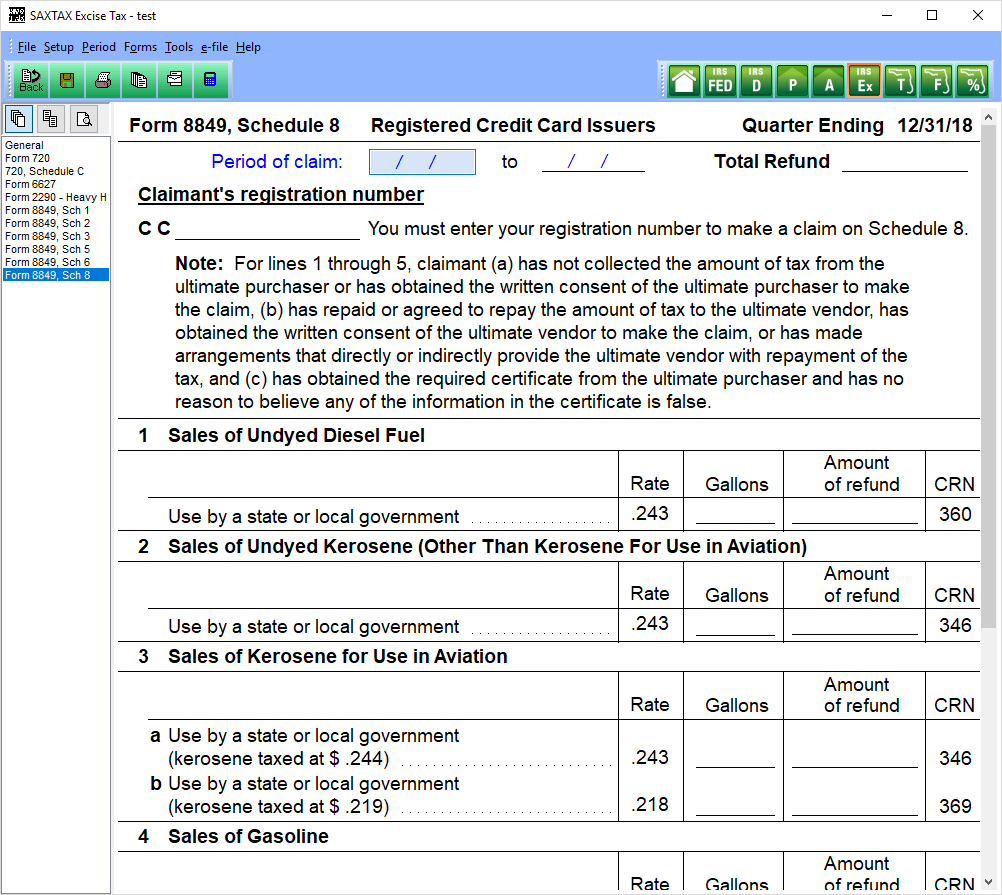

| Form 8849 Schedule 8 - Registered Credit Card Issuers |

The Excise Tax Program includes Form 8849 Claim for Refund of Excise Taxes along with Form 2290 Heavy Vehicle Use Tax and Form 720 Quarterly Federal Excise Tax Return.

Download a Demo or Order the Excise Tax Program now.

[sg_popup id="919" event="click"] [/sg_popup] [/sg_popup] |

[sg_popup id="922" event="click"] [/sg_popup] [/sg_popup] |

[sg_popup id="923" event="click"] [/sg_popup] [/sg_popup] |

| 8849 Schedule 1 | 8849 Schedule 2 | 8849 Schedule 3 |

[sg_popup id="924" event="click"] [/sg_popup] [/sg_popup] |

[sg_popup id="925" event="click"] [/sg_popup] [/sg_popup] |

[sg_popup id="926" event="click"] [/sg_popup] [/sg_popup] |

| 8849 Schedule 5 | 8849 Schedule 6 | 8849 Schedule 8 |

8849 Program Features

| Print Preview | Handles refunds for Forms 2290 and 720 |

| Annual filing for 2290 refunds | Custom Transmittal Letters |

| Quarterly filing for 720 refunds | e-filing |